We tend to think of extraction in physical terms, such as mining, deforestation, drilling. But extraction is also relational. It’s taking data without consent. It’s piloting programmes for impact reports that communities never asked for. It’s demanding stories of trauma in exchange for funding. It’s time-bound investments that leave when the grant cycle ends… or when the headlines move on.

Even in the world of “impact,” the capital pipeline remains worryingly extractive. Projects are measured by how much they scale, not how much they restore. Funds are judged by their speed of deployment, rather than the depth of their accountability and transparency. And communities — particularly those on the frontlines of the climate crisis, conflict, or colonial legacy — are too often treated as passive recipients rather than active designers.

If we’re serious about systems change, we need to move from extraction to regeneration. And this needs to happen in capital, in design, and in power.

The Quiet Harm of “Well-Meaning” Capital

Impact investing has grown rapidly in recent years, with currently over a trillion USD globally of AUM right now. Billions are now earmarked for climate solutions, social enterprises, and “inclusive” development. But the structure of that capital (who designs it, who controls it, and who is accountable when/if it fails) has barely changed. Despite all the new language, much of the system is the same.

We see capital extracted through the hyper-documentation of communities without clear consent, or the expectation that people in crisis should perform their suffering for grants or visibility. We see projects designed with minimal local input, where “co-creation” means sending a survey after the structure is done. We see donors who make funding contingent on aesthetic outputs, not lived outcomes, as well as zero focus on anything resilient or long term. And perhaps most insidiously, we see funders leave when the metrics no longer look shiny or they cannot be packaged nicely in their annual report anymore.

The end result? Exhausted communities. Silenced voices. Burned bridges. And worst of all, missed opportunities for real and genuine transformation.

Extraction Isn’t Just a Flaw, It’s a Design Feature

Most capital still flows through pipelines that treat communities as sites of implementation, not as sites of knowledge. The very people closest to the problems are rarely asked to shape the solutions. Instead, they’re brought in late, often under frameworks that were never made for them.

Frontline actors are expected to deliver on externally defined KPIs, while navigating complex, broken systems that donors rarely bother to understand. They’re asked to absorb shocks, such as delayed funding, political volatility or administrative burden, all while remaining “resilient.” Then, when the impact falls short, they’re the ones writing the lessons-learned section, unpaid, so funders can “pivot” and pilot again elsewhere. This is not just a moral problem, rather it’s a systems failure.

The projects which are extracted from their contexts, where they are stripped of historical nuance, political dynamics, or relational depth, are way more likely to collapse. Or worse, replicate harm under a new name or logo. Because without rootedness, there’s no feedback loop, correction or accountability. When capital prioritises speed and optics over context and care, the results are: fragile partnerships, surface-level success and performative inclusion.

Regeneration as a Financial Framework

So what could a regenerative capital pipeline look like? Regeneration is often talked about in ecological and physical terms, such as restoring soil, healing forests and supporting biodiversity. But it’s also a social and financial logic. Regenerative capital doesn’t just ask, “How do we sustain what exists?” It asks, “How do we repair what’s been harmed?” and “How do we return more than we take?”

A regenerative approach to capital is built on four interconnected principles:

- Consent. Communities have a right to define how they are engaged or whether they want to be engaged at all. Consent is a process of relationship-building.

- Reciprocity. If knowledge, labour, or stories are shared, there must be tangible returns. This includes financial returns, but also power-sharing, visibility, and long-term solidarity.

- Repair. Where harm has been done (for example: through colonisation, displacement, or even failed past projects) funding must include mechanisms for accountability and reparation.

- Circularity. Capital shouldn’t just move into a community and then flow out to repay external stakeholders. It should circulate internally, through cooperative ownership models, reinvestment schemes, or community-managed funds, and build capacity over time.

There Are Already Models Leading the Way

The good news is: regenerative finance isn’t theoretical. Rather, it’s here, very much alive, tested, and thriving at the edges of formal systems. Often led by movements rather than markets, these models show us what capital can look like when it’s built on consent, collective power, and cultural integrity. These are not just interesting case studies, they are actually working blueprints of how things can actually work for the better.

We see this in LandBack funds, like the NDN Collective’s LANDBACK campaign, where land is not just protected, but returned to its rightful stewards. These are not one-off land donations driven by corporate guilt or PR cycles, but part of multi-generational strategies to restore Indigenous governance, revive ecological stewardship, and heal the intergenerational trauma caused by forced displacement and extractive land policies. The NDN Collective doesn’t just fight for physical land, but they invest in the legal, cultural, and financial infrastructure needed for communities to thrive on it. In doing so, they reframe land not as an asset, but as ancestor, teacher, and responsibility.

We see it in Indigenous-led investment funds, like Raven Indigenous Capital Partners in Canada or Fondo Acción Solidaria (Fasol) in Latin America, which design financing structures rooted in cultural values, not colonial ones. These funds reject conventional investment models that prioritise short-term profits and external control, and instead, embed principles of collective stewardship, intergenerational responsibility, and community resilience. This approach ensures capital flows in ways that honor Indigenous sovereignty, support self-determination, and strengthen local economies from within rather than imposing external agendas. Their governance models are participatory by default, allowing for decision-making to be shared among community members, elders, and knowledge keepers, because anything less isn’t legitimate or correct.

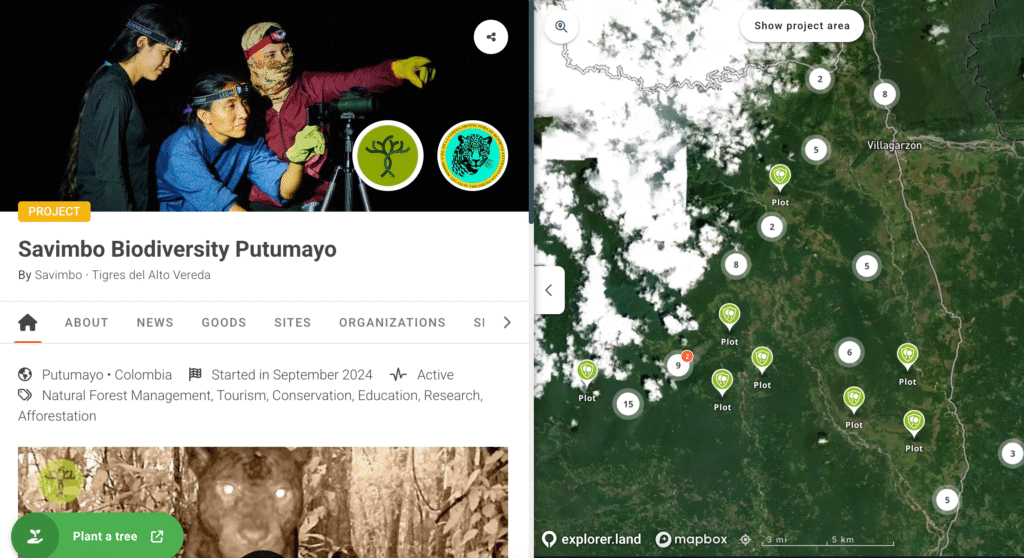

We see it in biodiverse credit cooperatives, like Savimbo, a company in Colombia, which has been created by, and for, indigenous peoples and local communities. At Savimbo, ecological knowledge isn’t extracted by remote aggregators or external experts, but is co-defined, verified, and monetised directly by local and Indigenous communities themselves. Cooperatives or Companies like Savimbo reject the usual top-down, market-driven approach that treats nature as a mere asset to be traded. Instead, they reward long-term stewardship and collaboration over short-term speculation, recognising the deep, place-based expertise communities hold about their ecosystems. By putting the power to define what counts as biodiversity (and crucially, what it’s actually worth) into the hands of those who live in and care for these landscapes, they shift power dynamics profoundly. Rather than forcing nature to fit market norms, they invite the market to meet nature and its collaborators, on their terms.

We see it in care income pilots, which are radical yet intuitive proposals to pay people for the invisible labour that holds society together: childrearing, elder care, grief work, community healing. These pilots challenge the idea that care is charity or should be unrewarded. Instead, they frame it as infrastructure and foundational to any economy worth building (which it very much is). Without unpaid, behind the scenes labour, our society would not be able to function in the way that it does now. These models show that when care is dignified, resourced, and respected, entire communities become more resilient. In Ithaca, New York, for example, a guaranteed income pilot provided $450 per month to 110 unpaid caregivers, including parents, those caring for elders, and people supporting chronically ill loved ones. No proof of poverty was required. The goal wasn’t to rescue, rather it was to recognise.

We see it in the frameworks of Restorative Economics, shaped by thinkers like Nwamaka Agbo, which advance a “just transition” for post-extractive communities, by using finance not to cushion displacement, but rather to fund community-owned regeneration. Rooted in the legacy of Black radical tradition and land-based justice, this model centres those most impacted by racial capitalism and environmental harm, not as recipients of aid, but as designers of new economies. Rather than patching over the damage with philanthropic short-term fixes, Restorative Economics calls for reparative investment, aka capital that heals, redistributes, and restores power to where it was taken.

We see it in the solidarity economy and grassroots feminist funds, which move money in ways that are redistributive, reparative, and relational, with accountability that flows in multiple directions, not just upward. These are ecosystems, not hierarchies: where trust is built through proximity, decision-making is shared, and capital is circulated, not concentrated. Funds like FRIDA and JASS prioritise long-term relationships over short-term metrics, often offering core, flexible support rather than rigid project grants. They recognise that the people best positioned to lead change are already doing the work and what they need isn’t oversight, but resources, space, and solidarity.

A Final Word

Regeneration is a necessity. The question isn’t whether we change the way capital moves, it’s how soon we’re willing to do it and who we’re willing to follow in getting there. So let’s move capital differently. Let’s listen more, design less, fund the long-term, repair the damage and start building the conditions for regeneration.

If you’re a funder, a strategist, or a builder navigating these questions — get in touch. Gia exists to design with, not for. To help realign power. And to ensure that the future of impact is built on more than good intentions, but rather a world which is built on repair, reciprocity, and regeneration.